This is what real

savings looks like.

The proof is in the numbers.

At CU NextGen, we do more than promise savings. We deliver it – and we have the numbers to back up our claims. Thanks to our hardworking automation solutions, our clients have saved their time, money, and sanity – to become more productive and power their credit unions’ digital transformations.

Save time and money

Boost productivity

Power the future

Sponsors

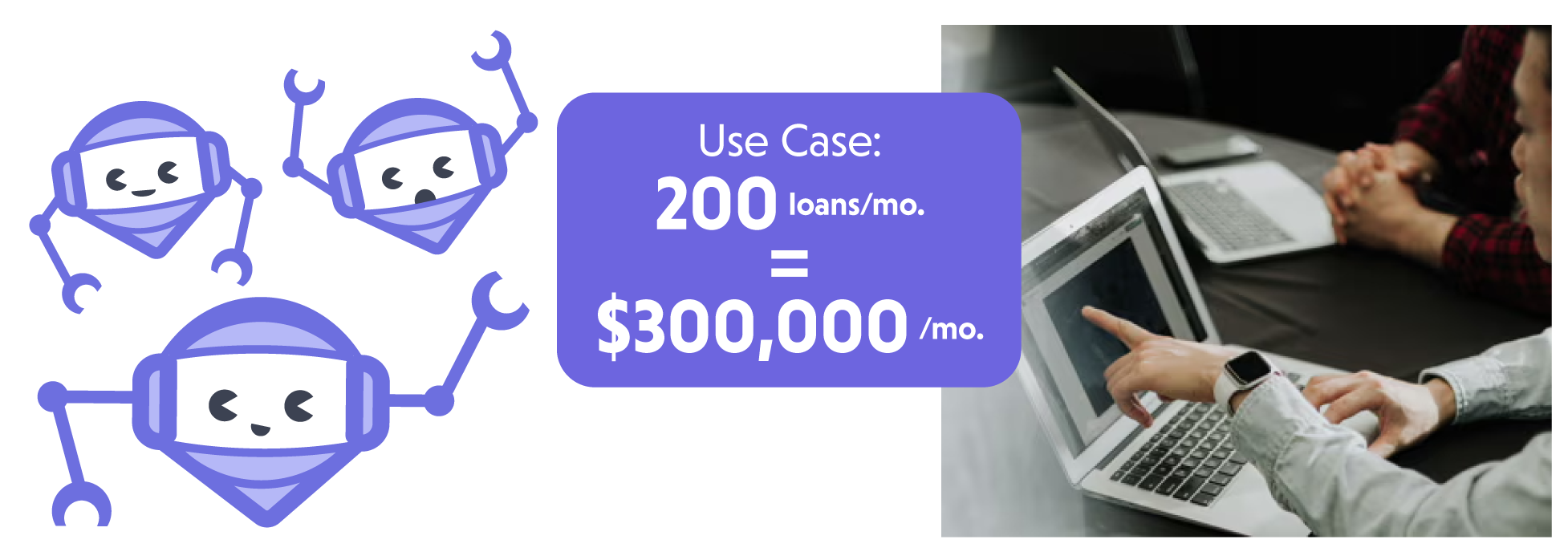

Automated Microloan

Loans made lightning-fast

Built on CU NextGen’s no-code app platform, our award-winning Automated Microloan allows members to quickly complete a loan application via website or mobile app 24/7 – and then see if they qualify for quick cash when they need it most. With the power of automation, Automated Microloan can quickly approve members, depositing funds into their credit union accounts within minutes, saving credit union employees their time, too.

A win-win

Automated Microloan captures business with benefits:

- 24/7 instant approval and funding

- No credit check

- Up to $2,000 deposited into the member’s account

Use Case: PIN Change

Automation to the Rescue

In our PIN change use case, we achieved 100% automation, leveraging robotic process automation to provide a simple, intuitive way for members to update their account and card PINs via self-service technology. It was a small project with big impact.

+

23,920

Estimated saved minutes per year

+

$22,366.37

Projected ROI

through 2025